Why Startups Fail[Part 1-Intro]

Startup success comes from making difficult trade-offs, good decisions and luck. This book explains those trade-offs and difficult decisions without providing a set recipe anyone can follow.

book by Tom Eisenmann

Amazon link

Book provides a mini MBA for anyone interested in being a founder of a company while using the lens of startup failure.

These are notes I took for myself while reading the book. It is not a review or a comprehensive summary. I'm posting these on my blog in case it might be helpful to someone but I suggest you read the entire book to fully understand the concepts mentioned.

What is failure?

Entrepreneurship - pursuing a novel opportunity while lacking resources

Failure - Did early investors make money?

Risks - Demand risk, Technological risk, Execution risk, Financing Risk

The failure patterns

Early stage

Good Idea, Bad bedfellows**

Getting the right stakeholders, yourself, cofounder, employees, strategic partners, investors

False starts

Starting before customer development

False positives

Early adopters are not mainstream customers

Late stage

VCs lose ⅓ of money in late stage startups.

Speed trap

Saturates the original market.

Success invites rivals

Help wanted

Financing risk

Gaps in senior management

Cascading miracles

Multiple things need to fall in place for a startup to be successful

Likely areas to watch out for:

- Customers change behavior

- New technologies

- Sign up major corporation as partner

- Get regulatory relief or gov. support

- Raise stupendous amount of capital

Handle failure

Pulling plug is not easy

Failure is slow motion

Beware Emotional and psychological effects of failure.

Causes of failure

Misfortune or Mistakes

Horse or Jockey

Jockey- industry experience, general ability, temperament

First time founder and entrepreneurs who previously failed have the same likelihood of success

Catch 22

Resource/opportunity catch-22:

- Cannot pursue opportunity without resources.

- Cannot attract resources until the opportunity is pursued.

Reduce resource requirements

- Resolving - MVP

- Hazards: False start. Build MVP before customer development

- Shifting - Partnering

- Hazzard:Can be difficult to convince partners. Startup will be low priority for partner

- Deferring - staging

- Hazzard: Money from investors who don’t add value in desperation;

- Downplaying opportunity related risks - Storytelling

- Hazzard: Overconfidence can lead missing signals. Self delusion

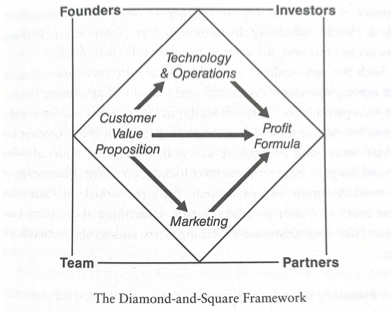

The diamond and square matrix

Opportunity[diamond]

Customer value proposition

Offer a sustainably differentiated proposition with strong, unmet customer needs.

Moats for sustainable advantage:

- Proprietary assets: patents, brand, access to raw material

- business model attributes: high switching costs and network effects

Decisions:

- Single market or multiple segments

- How much innovation? New business models, new technology, combining existing technology

- Does it require a change to customer behavior?

- Another catch-22: without innovation a product is not differentiated but too much innovation will overshoot customer’s needs

- Low touch or high touch? One size fits all or customized?

- Low touch-

- Can be scaled

- lacks differentiation and cannot command a price premium

- High touch

- Customized solution

- Superior service

- Low touch-

Technology and Operations

Startup must invent, build, deliver and service products.

Decide whether to build or buy.

Marketing

Build it and they will come???

Big bang launch

Premature scaling of marketing and product development is a widespread cause of startup failure

Profit formula

Cannot choose a profit formula independently but choices about three other resource areas determine it.

Unit economics: Gross Profit(revenue-variable costs) per unit sold

Must cover:

- Marketing and overhead costs

- Investments for further growth

- Interest

- Taxes

- Profit

LTV/CAC ratio

Aim for > 3

Break-even point - Gross profit > tax + marketing + fixed costs + new investments

Resources[square]

The four resources should complement one another

Founders

- Industry Experience

- Functional Experience

- Temperament

Entrepreneurs are more likely to be over confident

- fuels resilience,

- may cause taking on too much risk

- attracts talent and capital

Headstrong vs. Tentative

Tentative- underestimate effort required, no passion, throw in towel quickly, cannot attract talent

Headstrong- difficult to work with; defensive; judgemental; does not delegate; ignores advice; inflexible

Team

Hire for attitude or skill?

Attitude-hardworking, passionate, may not be able to solve tough technical challenges

Skill-instant performance boost

Generalist or specialist

Generalist-able to move from task to task

Specialist-might be hard to hire, too quick to embrace solutions that worked previously, might not be able to pivot with company\

Investors

Do we have funder fit?

When to raise?

“Fume date”- when old capital runs out

Investors move in herds to hot sectors

How much to raise?

Greed vs fear

Greed-limit dilutions

Fear-no capital buffer for setbacks\

Too much $$$:

- complacency, laziness and arrogance

- Over hiring

- Missed deadlines - no forcing function

From whom?

Investors can provide advice, coach, network introductions, tips to raise next round.

Misalignment:

- risk/reward trade offs - may force entrepreneurs to take too much risk

- Can they provide additional capital as Bridge funding or investing in the next round?

- Investors need enough capital in their current fund to provide new funding since there might be a conflict of interest to provide the investment from a follow-up fund.

Partners

Partnerships can have a power imbalance.

Big companies take a long time to decide

they may copy the startups technology and strategy

Can drag negotiation to build a bargaining advantage while the startup is running out of cash.

A partnership can pull up a startup by providing cash and brand recognition.