Why Startups Fail[Part 3 -Late Stage startups]

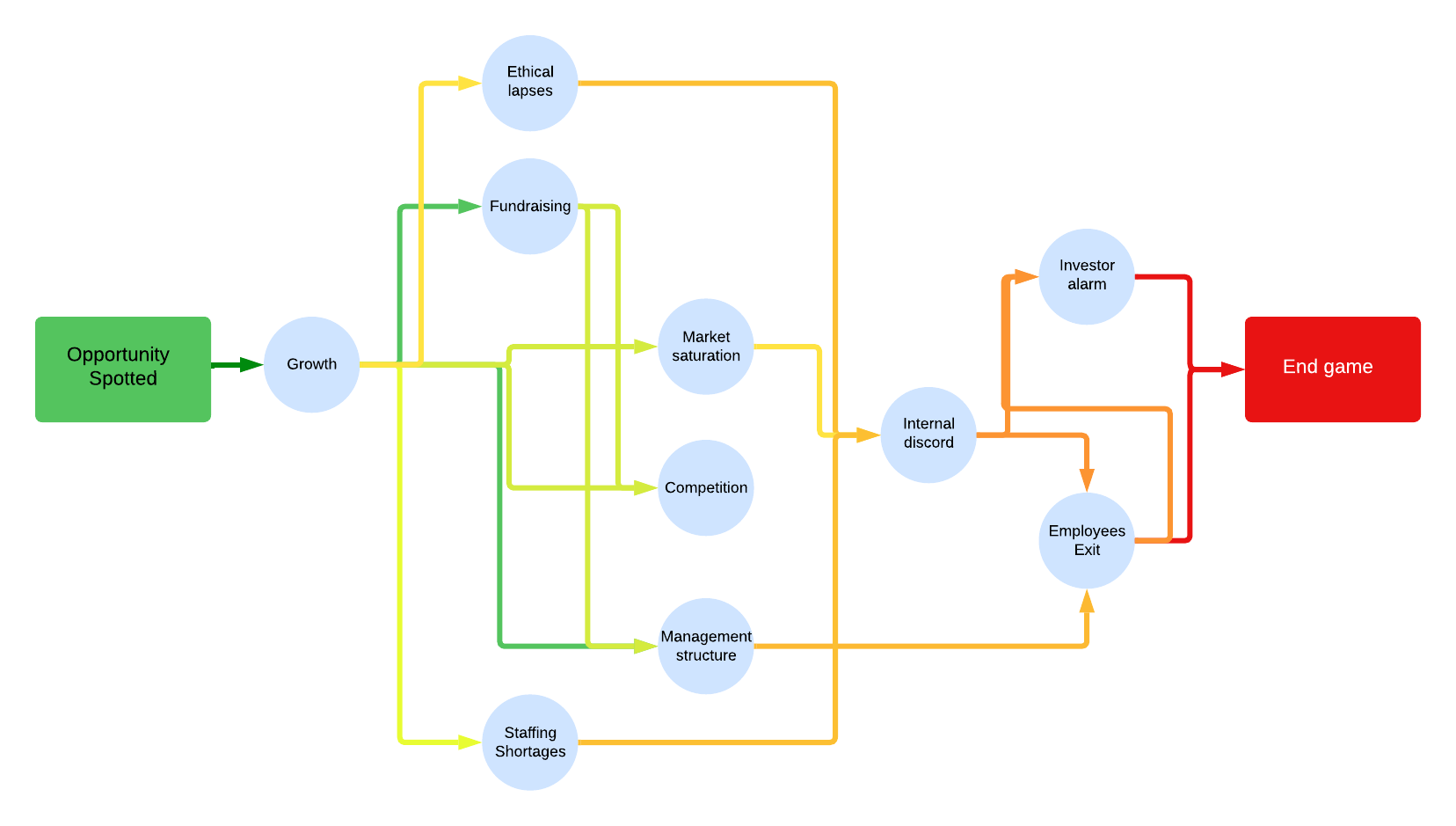

Book describes issues late stage startups face. Although get out of the early stage is difficult, this stage presents its own challenges.

Out of the frying pan

Late stage - Series C and 5 years old.

⅓ fail to earn positive returns.

Opportunity challenges

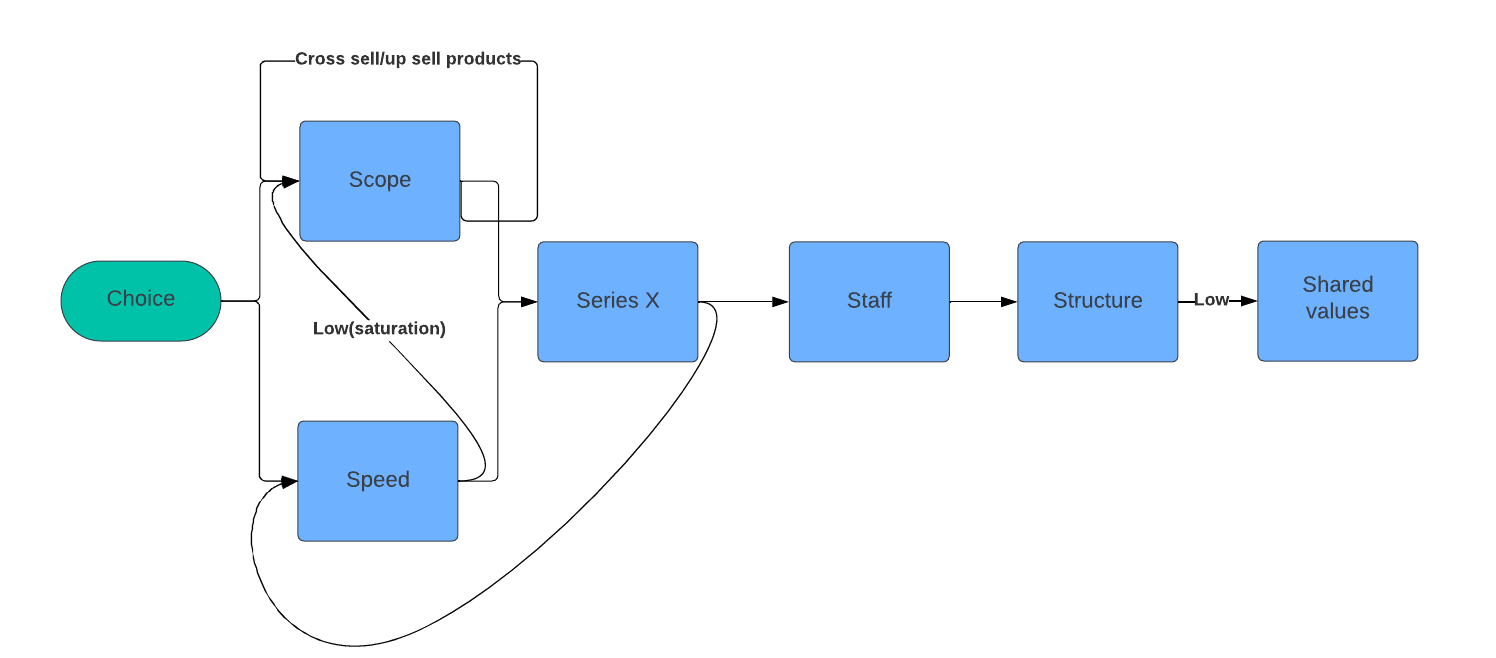

Set ambitious goals for speed and scope

Speed - pace of expansion

Scope - geographical reach, product line, innovation, vertical integration

“Goldilocks dilemma”

Resource challenges

Finance - cannot raise capital

Team

- must hire specialists on team of generalists

- Fluid management gives way to formal structures and systems

Organizational

- Distract when marketplace challenges require attention

Speed

Decide how quickly to expand core business

Scope

Geographical reach

- Costly

- Stretch management too thin

- Every market has competition, regulations & cultural differences

Product line

- Speed up development by repurposing tech

- Gain operations efficiencies by using slack capacity

Innovation

Risks:

- Raises cost of switching

- More marketing spend to educate customer

- Product development delays due to novel tech

Pros:

- ROI on new features for existing products turn negative

Vertical Integration

Risks:

- Requires investments

- Mgmt. has to acquire a new skill

Pros:

- Increases profit margins

- More consistent quality

- Mission critical functions in house

Mergers and Acquisitions

Risks:

- Overpayment

- Disappearing talent

- Integration risks - technology incompatibility, org design, cultural misfit

Pros:

- Time saving

- Cost saving after reducing redundant functions

- Avoid early stage startup risks

Series X

Growth pressures

Winner’s curse - VCs bid up startup value. Next round is harder to raise.

Down rounds - signals firm is struggling. Will make it difficult to attract talent.

How realistic is it to sustain momentum?

Funding risks:

- Sector falls out of favor

- Need contingency plan in case of funding drought

CEO succession - when investors > founders on board, founder loses control and ability to establish strategic priorities

Board priorities - to earn a return for late state investors, startup has to continue to remain aggressive.

Structure

Formalize org chart and introduce management systems

- Information flows to where’s it’s reduced

- Coordinate complex activities

- Cross functional conflict needs resolution

Formal org change

Additional management layer to tie break

Management structure:

- Strategic and operational planning

- Financial planning

- Performance tracking

- Employee recruitment and development

Shared Values

Employees know what to do

New employees may view employment as just a job. Lead to decay in culture. Take no initiative or be committed.

Promote culture:

- Mission and values statement

- Communicate and reinforce relentlessly

- Reinforce culture through actions

- HR practice - culture fit interview

- Measure whether employees understand mission and live up to values

Staff

Genaralists to specialists.

New CEO and management required. Skills and attitudes that makes good early stage founders is not the same as managers

"Peter pan syndrome"-long for startup's early days.

Two paths

Speed or scope

Base camps

Use quick win to:

- Refine technology

- Build early momentum

Speed trap

RAWI test

Ready - proven business model with positive profit model

Able - have human and capital resources

Willing - founders, employees and investors eager to grow

Impelled - due to rivals? Sleeping dragons? Network effects

RAW is required and founders should take test quarterly

Ready

Sustainable product market fit

LTV/CAC > 3\

Risks:

- Saturation

- Quality decrease

- Attract rivals

- Founders

- Equity dilution, get sidelines, work long hours

Use cohort tracking to mitigate saturation risk

Warning: this is lagging indicator

Increase in CAC indicates saturation.

Find indicators that are more quickly observable.

Able

Have capital, talent and leaders, structure and management systems.

Hiring issues. Avoid:

- Just hiring warm bodies

- Pressure current employees to work harder. Burn out!

- Skimp on training

Willing

Entrepreneurs has different risk-reward tradeoff than late stage investors.

Continued pressure to grow

Impelled

Network effects

Types of networks:

- Two sided

- One sided

- Cross sided

Adjusted LTV/CAC formula

LTV(1+v)/CAC > 1; v = viral coefficient

Might be worth it to seed initial customers to determine v

Switching costs

Upfront costs

- Find and vet new service

- Terminate old account

- Penalties

Disruption risk

- Changing trusted supplier not easy

Major first moved advantage

Scale economics

Reduce unit costs

- High fixed costs

- Learn by doing opportunities

- Learning curve in manufacturing

- Develop proprietary tech

Do not overinvest when:

- Cannot calculate CAC

- Hoping a greater fool will buy startup. Maybe exploiting a funding bubble

- Overconfidence and wishfull thinking

De-escalate competition when:

- Small # of players

- History of interaction

- Expect to continue to interact

- Shrared beliefs about market opportunity

- Transparent moves

- Short lag between decision and observable moves

Help wanted

Capital

Venture capital funding is prone to boom and bust cycle which effects late state ventures more since they require more capital.

Hard to find new investors when existing ones won’t invest.

Mitigate financing risks:

- Be alert about cycles

- Raise money from early investors who can provide bridge financing or be able to invest in next round

- Raise more money than required

- Have low fixed cost for flexibility. Get a short term lease.

Missing managers

Specialist from big companies can fix metrics without making an overall impact by making political moves.

Startups also need leaders to initiate moves.

Lower risk- bring a junior specialist on board. Catch-22- no one there to manage or help junior specialist grow.

Senior specialists:

- Hire using network

- Build key processes and systems

Add a HR to:

- Create process for onboarding and offboarding

- Talent development

- Manager organization structure

- Preserve company culture

- Council senior executives

Missing Systems

In a startup every function requires new systems and processes.

Having the right system in place effects scalability.

Decision making process- Who can propose initiatives? Who provides input? Who makes decision?

Moonshots and Miracles

Moonshots - meet numerous complex goals or crash

Moonshot -> momentum -> sunk costs -> “escalation of commitment”

Often launched by charismatic or egomaniacal founder

Egomaniacal founder

- Takes high tech risk

- Makes high funding demands

- Relies of big asks from partners

- Assumes government support

- Thinks there is no competition

- Estimates high demand

How to estimate demand?

- Assume survey respondents overestimate purchase intent

- Do a smoke test

- Get feedback on prototype

- Do not stay in stealth mode, get actual feedback and redo estimates

Dealing with delays:

- Accept delays as part of developing a moonshot

- Add people

- Freeze functionality

- Cut corners - remove key features or ship with bugs

Harness a monomaniacal founder:

- Use zeal and charisma to mobilize resources

- Have a “reality distortion filed”

- Watch out for narcissism

- Escalation of commitment

- Lacks empathy and takes credit for other’s work

- Surrounded by yes men

Board best practices:

- Primary way VCs add value

- Have independent directors(not investors or senior managerment)

- A CEO of a previous successful startup

- Closed session

- Review CEO performance

- Review self effectiveness